Central Asia in the Energy Transition

Svante E. Cornell and Brenda Shaffer

December 4, 2024

The United States, Europe, the United Nations and more are promoting a top-down energy transition from fossil fuels to renewable energy, which shows no signs of emergence. Under this scenario, Europe and the global market are likely to maintain demand for the energy riches of Central Asia for many decades to come. The gas market of Central Asia itself requires additional gas volumes as well. In order to lower carbon emissions and air pollution and improve public health in Central Asia, the ideal policy in the region is increased access to natural gas that can replace the widespread burning of biomass and lump coal. Current European policies promote expanding electrification and is leading to a new look at nuclear energy. Accordingly, the uranium deposits of Central Asia have become of high commercial and geopolitical interest.

Kazakhstan's First NPP: Economics and Geopolitics

By Sergey Sukhankin

In Kazakhstan’s recent referendum, over 71 percent of voters endorsed building the country’s first nuclear power plant (NPP), marking a significant step toward advancing this major infrastructure project. Strongly supported by President Kassym-Jomart Tokayev and the national political elite, the NPP is expected to address Kazakhstan’s current and projected electricity needs. Additionally, as the world’s leading uranium producer, Kazakhstan stands to benefit from self-sufficiency in uranium enrichment, reducing its reliance on external suppliers. A key issue now centers on which entity will secure the NPP construction contract, with geopolitical considerations expected to weigh heavily alongside technological and economic factors.

BACKGROUND: Discussions about constructing a new, modern NPP in Kazakhstan date back to the early 2000s. From 1973 to 1999, the country operated an NPP in Shevchenko (now Aktau), which was closed as part of Kazakhstan’s de-nuclearization policy. However, tangible steps toward this goal only began in 2021, following a severe electricity shortage linked to a spike in cryptocurrency mining and pressures from the COVID-19 pandemic. At the same time, the European Union’s push for sustainable trade relations led Kazakhstani political leaders to prioritize renewable energy expansion in the national economy. In promoting a public vote for constructing an NPP, the government highlighted four main priorities: averting a potential energy crisis amid rising electricity demand; mitigating environmental risks linked to unsustainable energy sources; reducing Kazakhstan's reliance on electricity imports from Russia; and preserving the competitiveness of Kazakh exports to the EU. Despite compelling arguments supporting the nuclear power plant project, significant concerns have emerged from local experts, civil society, and the public. A primary worry centers on the risk of nuclear accidents, with Chernobyl and Fukushima serving as stark reminders of possible environmental catastrophes. Specific fears include potential harm to the fragile ecosystem of Lake Balkhash, which is already experiencing drying and may face further degradation from plant operations. Moreover, experts emphasize Kazakhstan's current lack of expertise and infrastructure for safely managing nuclear waste, leaving the issue of radioactive waste disposal unresolved. The economic viability of Kazakhstan's nuclear project is also a subject of concern. Critics point to the high construction costs and question the plant’s long-term financial sustainability, especially given the uncertain outlook for future electricity demand. Some experts suggest that the expected surge in demand may not occur as projected. They argue that even if demand does rise, Kazakhstan has alternative options, such as expanding renewable energy sources and improving the efficiency of the current electricity grid, which could address energy needs without relying on nuclear power. Geopolitical concerns further drive opposition to Kazakhstan’s nuclear project. Recent incidents at nuclear facilities, such as Zaporizhzhia and Kursk, illustrate the vulnerability of such infrastructure during conflicts, highlighting risks if similar instability arises in Central Asia. Additionally, Kazakhstan’s limited technical expertise and financial resources mean it would likely depend heavily on foreign partners to build and operate the plant. Critics argue that this reliance could compromise Kazakhstan’s sovereignty, with potential implications for the country’s long-term energy autonomy and geopolitical independence.

IMPLICATIONS: Four main contenders have emerged to construct Kazakhstan’s NPP: Russia’s Rosatom, China’s National Nuclear Corporation (CNNC), Korea Hydro and Nuclear Power (KEPCO), and France's Électricité de France (EDF). While Kazakhstan has pledged to base its choice on factors such as economic feasibility, technological reliability, and environmental safety, Russia and China realistically lead the race. Although France and South Korea bring significant expertise, high construction costs (potentially exceeding US$ 12 billion) and geopolitical dynamics may limit their competitiveness. Thus, Kazakhstan appears to face three pragmatic options moving forward. One option is for China to assume the role of sole contractor for the project, a scenario with several competitive advantages. China offers relatively lower construction costs compared to French and South Korean alternatives and maintains a robust trade and investment relationship with Kazakhstan, enhancing its influence as an economic partner. However, the feasibility of China proceeding alone is uncertain. Moscow might perceive China’s unilateral role as a diplomatic slight, as Russia has become a key strategic partner and potential Arctic access point for China. Moreover, it remains unclear if China is willing or prepared to undertake this project independently, given its geopolitical sensitivities. A second option is to appoint Russia as the sole contractor, a role Moscow has long pursued. Between 2010 and 2019, President Vladimir Putin personally lobbied Kazakhstan to select Rosatom as its nuclear plant builder. Given Russia’s current geopolitical isolation and diminishing network of allies, Moscow might view any exclusion of Rosatom as a serious diplomatic offense. The recent “grain war” between Russia and Kazakhstan—allegedly sparked by Kazakhstan’s refusal to join BRICS—demonstrates how swiftly Moscow might respond with retaliatory measures if it perceives a breach in loyalty or alignment. An analysis of Russian sources indicates several strategies Russia might use to “encourage” Kazakhstan to prioritize Rosatom’s bid. A primary leverage point is Kazakhstan’s reliance on Russian territory for transporting export-bound oil. Approximately 80 percent of Kazakhstan’s oil exports pass through Russia, and oil revenue constitutes about two-thirds of Kazakhstan’s national budget. Any disruption in this transit route could precipitate a fiscal crisis for Kazakhstan, with severe implications for the stability of its national budget. A second leverage point is Russia’s role in alleviating Kazakhstan’s energy deficit through electricity exports. Russian experts warn that any abrupt cessation of this supply could lead to severe energy shortages in Kazakhstan, potentially triggering economic and political instability. These pressure points are further highlighted by recent incidents, such as the explosion at Kazakhstan’s Tengiz oil field, which occurred shortly after President Tokayev discussed with EU officials increasing Kazakh oil exports to compensate for reduced Russian supplies. These events suggest that- Should Kazakhstan consider alternatives to Russia for its NPP construction, it might face similar pressures or retaliatory actions from Moscow. Kazakhstan’s reliance on Russia for both oil export infrastructure and electricity supply exposes the country to significant vulnerabilities. Nearly 80 percent of Kazakhstan’s oil exports pass through Russian territory, and oil revenues account for approximately two-thirds of the national budget. Any disruption to this transport network could result in severe economic consequences, potentially destabilizing Kazakhstan’s fiscal position. Similarly, Kazakhstan’s electricity deficit is largely covered by imports from Russia. Russian experts caution that if Russia were to cut off this supply, Kazakhstan would face a precarious situation, where both political stability and economic restructuring could become unfeasible. These dependencies highlight Kazakhstan’s vulnerability to Russian influence, as demonstrated by the 2022 explosion at the Tengiz oil field, the country’s largest, which occurred shortly after President Tokayev’s discussions with EU officials about increasing Kazakh oil exports to compensate for reduced Russian supply due to the invasion of Ukraine. This incident underscores Russia’s capacity—and potential willingness—to retaliate against Kazakhstan should the country act in ways that conflict with Russian interests. A third option is to form an international consortium to oversee the construction of the NPP. This approach could provide a balanced compromise, allowing Russia to participate without being the sole contractor, thus reducing the risk of secondary economic sanctions. Such an arrangement might appeal to Moscow, as it would obscure Rosatom’s central role while still involving Russian expertise. Notably, President Tokayev has rhetorically supported the idea of an “international consortium,” suggesting that this could be the most feasible solution. However, several uncertainties surround the international consortium option. A significant challenge is that the construction of the nuclear reactor, the core component of the NPP, cannot be easily divided among multiple parties. This raises the critical issue of who would be responsible for sourcing and manufacturing the reactor, as the origin of this essential component remains unclear. Furthermore, the distribution of responsibilities within the consortium could lead to complications. Some members would likely take leadership roles, while others would play secondary, supportive functions. The precise allocation of these roles, and how they align with the interests of the participating companies, remains uncertain, potentially creating tensions within the consortium and complicating cooperation and decision-making.

CONCLUSIONS: The construction of Kazakhstan’s NPP will provide crucial insight into Russia’s influence in Central Asia, a region where assertions of Russia’s diminishing role may underestimate its true significance. The outcome of this project could offer a clearer picture of Russia’s geopolitical and economic standing in the region. If Kazakhstan ultimately selects Rosatom as the sole bidder—an outcome that seems less probable—or if Russia’s state corporation participates within an international consortium, it will symbolize Russia’s continued strategic presence in Central Asia. Such a scenario would highlight Russia’s ability to retain substantial leverage in the region, despite competing global interests. Whether as the lead contractor or a key consortium member, Rosatom’s involvement would likely reinforce its central role in the region’s energy infrastructure and broader geopolitical affairs.

AUTHOR’S BIO: Dr. Sergey Sukhankin is a Senior Fellow at the Jamestown Foundation and the Saratoga Foundation (both Washington DC) and a Fellow at the North American and Arctic Defence and Security Network (Canada). He teaches international business at MacEwan School of Business (Edmonton, Canada). Currently he is a postdoctoral fellow at the Canadian Maritime Security Network (CMSN).

Nuclear Power Plant in Uzbekistan: Energy and Geopolitics

By Farkhod Tolipov

August 21, 2024

During a state visit of Russia’s President Vladimir Putin to Uzbekistan in May 2024, after his re-election, it was officially announced that the long-anticipated construction of a Nuclear Power Plant (NPP) received a green light. A corresponding agreement was signed between the Russian Federation and the Republic of Uzbekistan. This decision caused wide public debate about the NPP, regarding its expediency, the environmental and security risks, as well as the geopolitical consequences associated with it. At the same time, the project signifies Uzbekistan’s growing dependence on Russia and a more pro-Russian drift in Tashkent’s foreign policy.

BACKGROUND: The first signals of the possible construction of an NPP in Uzbekistan appeared several years ago. It was then stipulated and justified with reference to the lack of sufficient gas reserves in the country. This pretext surprised many economic experts, political analysts as well as the public since Uzbekistan has for a long time, even during the Soviet period, occupied the highest positions in international rankings of gas reserves and gas production.

The issue of dwindling gas reserves is a big and ambiguous question because neither the government nor specialists have provided convincing explanations for the exhaustion of gas fields in Uzbekistan. Meanwhile, frequent blackouts have become a “normal” phenomenon during last two-three years – roughly corresponding to the period during which the NPP project has been officially promoted. Sudden and frequent blackouts taking place across the country have created the suspicion that they are not so much caused by the inability of existing energy infrastructure to satisfy the country’s growing energy needs and a lack of gas reserves, but are man-made and deliberate in order to convince people that there is no alternative to an NPP.

However, the overall agreements between Uzbekistan and Russia regarding the NPP, including the costs of the plant, environmental aspects, the disposal and utilization of nuclear waste, and many other concomitant questions of interest to the public and media remain opaque and secretive. It was in this context that Putin and Uzbek President Shavkat Mirziyoev announced the official start of the NPP construction project.

Initially, the NPP project was intended to consist of 2 large reactors of 1.2 Gigawatt each, at a cost estimated to US$ 11 billion. However, it has now been decided that the NPP will be a small plant consisting of 6 small reactors of 55 Megawatt each. Overall, the electricity that will be produced by the NPP is supposed to constitute about 15 percent of the total energy produced in the country. The NPP is supposed to become operational in 2033.

IMPLICATIONS: Proponents of the NPP construction argue that nuclear energy is widely used in the world, pointing to France, Germany, Japan, the U.S. and others. According to them, constructing the NPP is in Uzbekistan’s strategic interests and an instrument of sustainable development, since it will positively affect both economic growth and the population’s living standards. Moreover, they say that nuclear power is the only source of energy generation that meets all three pillars of the so-called energy trilemma established by the International Energy Agency – reliability of energy infrastructure; availability of energy for the population and industry; and no harmful effect on the environment.

While these assertions seem aimed to calm the excited public opinion, they do not withstand critical counterarguments. Numerous physicists, environmentalists, energy experts, political scientists and public activists have raised their voices against the NPP. In particular, according to estimates, it will be more expensive to produce electric energy in small reactors than large ones. Uzbekistan will face a large financial burden that will be carried by consumers. Also, according to estimates, Uzbekistan’s renewable energy sources can fully satisfy the country’s energy needs even without the NPP.

Meanwhile, multiple questions related to the construction and operation of the NPP as well as its geopolitical implications have not been addressed and no transparent calculations of key aspects of the NPP’s operation have been provided. These include the enrichment of Uranium from U²¹⁸ to U²³²; the system for cooling the reactor; the utilization of nuclear waste; the overall cost of the project; security aspects; as well as the increased reliance on a Russia that wages a war of aggression against Ukraine and threatens other former Soviet republics with its neo-imperial policy. In addition, the digitalization of the NPP operation raises questions regarding possible cyber-security aspects of the plant, which will definitely be exposed to such threats.

Importantly, this type of small NPP does not exist even in Russia itself, which uses small reactors only for icebreaker engines. Thus, the NPP in Uzbekistan will in fact constitute a first experiment with a number of risks attached.

When journalists and pundits began to inquire about the details of the NPP project and requested relevant information from governmental agencies, they received no response. To the contrary, media organizations were told by authorities that they should refrain from highlighting topics relating to the NPP. Despite the reluctance of government agencies to communicate information on the NPP and attempts to curtail media coverage, social networks and independent experts do discuss the issue and seek to keep it on the public agenda. A special group was even created on Facebook titled “Uzbekistanis are against the NPP.” Simultaneously, a similar NPP project is being discussed in Kazakhstan. In contrast to Tashkent, Astana has officially made it clear that a referendum will be held on NPP construction. However, in Uzbekistan, the decision comes before its justification.

The social and political drama related to the NPP has created the impression that the project corresponds to Russia’s interests rather than those of Uzbekistan. The enthusiasm with which Russia promotes this project cannot be considered and understood independently from the context of Russia’s war in Ukraine. Indeed, the NPP will serve triple objectives for Moscow. First, it will constitute political leverage for exerting pressure upon Uzbekistan. Second, it will provide one among very few instruments for mitigating economic decline and crisis in Russia due to international economic and financial sanctions. Third, it will help creating a false image that Russia is not isolated in world politics and has partners and allies. Given the establishment of a partnership in nuclear energy, Uzbekistan will hardly vote against Russia at future UNGA sessions.

It should be recalled that since 1997, Central Asia is proclaimed a Nuclear-Weapon-Free Zone (NWFZ). The NWFZ by its nature and essence is a broad concept; its ultimate goal is to safeguard the region against any form of nuclear threat. The question therefore arises whether the NPP can be considered a dual-purpose object, which could in certain circumstances be transformed into a weapon? After Russia’s attack on Ukraine’s Zaporizhzhia NPP, this question cannot be ignored and obscured.

Instead, Uzbekistan’s government seems to reiterate Napoleon’s saying: “One jumps into the fray, then figures out what to do next,” or “You commit yourself, then you see.”

CONCLUSIONS: While a number of countries utilize NPPs to produce electricity, most countries resolve their electricity needs by developing alternative energy sources such as solar, wind and hydro. Many countries are also cancelling their nuclear energy programs in favor of renewable sources. The straightforward and very simplistic attempts by proponents of Uzbekistan’s NPP to propagate for the project, in combination with the secrecy displayed by Uzbek authorities, are not only unconvincing but also raise suspicions that Tashkent engages in a mutual geopolitical gamble with Moscow.

The agreement signed between Tashkent and Moscow on the NPP lacks due scientific elaboration and national debates concerning all aspects and risks involved in the deal. Many experts, media as well members of the public are now raising their voices against the project, claiming that Uzbekistan is losing its sovereignty and independence and falling into dependence on Russia.

Indeed, this issue is far from routine and conventional, just like a nuclear weapon is considered a non-conventional weapon. Accordingly, policy in this special area also should be unconventional, taking into account the vital national interests of the country.

AUTHOR'S BIO: Dr. Farkhod Tolipov holds a PhD in Political Science and is Director of the Research Institution “Knowledge Caravan”, Tashkent, Uzbekistan.

The opinions expressed in this article are the author's own.

Impact of the US-Iran Confrontation on Central Asia

By Uran Botobekov

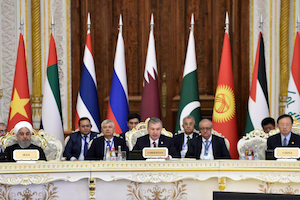

October 3, 2019, the CACI Analyst

Increasing political and economic pressure on Iran, exacerbated by the renewed economic sanctions resulting from the U.S. withdrawal from the 2015 nuclear deal known as the Joint Comprehensive Plan of Action (JCPOA), has led Tehran to seek support from the two major Eurasian political and economic powers Russia and China. Iran has also increasingly turned its attention toward its neighbors in Central Asia, which remain closely integrated into the political, economic and military projects of Moscow and Beijing. Central Asian leaders are well aware that a possible armed conflict between the U.S. and Iran would adversely affect Eurasian security.